Merci à B.A. pour ses courbes. Son texte suit… dans quelques instants.

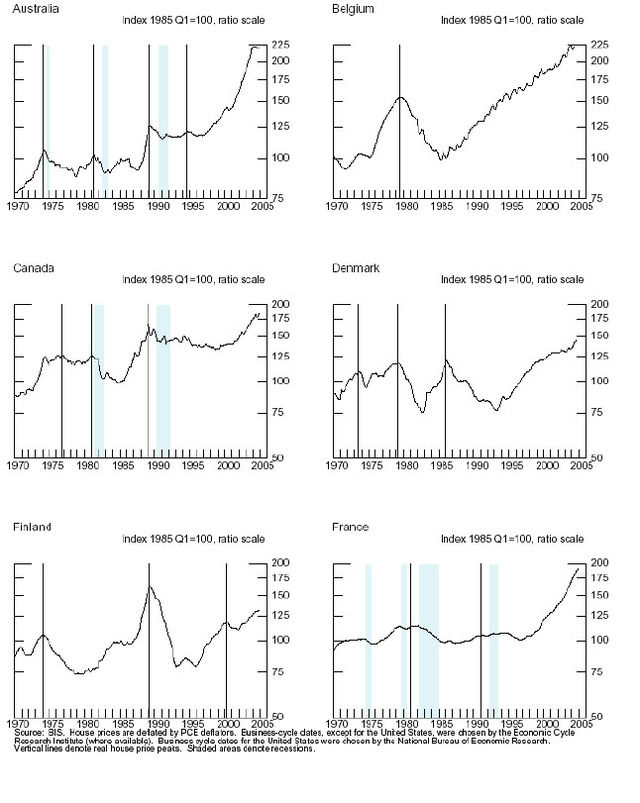

Que constatez-vous ? La courbe des prix français est proche de celle de l’Australie.

Et que se passe-t-il en Autralie ? Les prix de l’immobilier baissent, même assez vite. Lisez les anciens articles sur l’Autralie, j’avais déjà indiqué que l’Australie est probablement un maxi laboratoire. Il suffit d’observer ce lointain continent pour savoir ce qui nous attend.

Wait & see.

Australie : baisse du m² et nombre record de saisies

Les ventes de Wal-Mart en Baisse pour la 1ère Fois depuis 10 ans… Malgré les fortes baisses de prix réalisées pour tenter d’attirer les acheteurs…

Les consommateurs US sont RUINES !!!

http://housingpanic.blogspot.com/

http://www.washingtonpost.com/wp-dyn/content/article/2006/11/25/AR2006112500269.html

FLASH: Even with fire sale pricing, Wal-Mart to post same store sales decline for November

Market ain’t gonna like this one on next week. Flat sales are a real drop when factoring in inflation FYI.

And if you think sales are bad, wait until retailers start releasing their profit numbers – those are going to be even uglier as they chase each other to the bottom…

The US consumer, thanks in part to the housing crash, is finally spent.

Wal-Mart predicted a rare decline in monthly sales on Saturday, even as U.S. bargain-hunters jammed stores in search of gifts at the start of the crucial holiday shopping season.

Wal-Mart estimated that November sales fell 0.1 percent at its U.S. stores open at least a year — a closely watched retail measure known as same-store sales.

The retailer will provide a final monthly sales report on Thursday, when most other major chain stores report their November figures. This would mark Wal-Mart’s first monthly same-store sales decline since April 1996.

« We would frankly have expected better, » Merrill Lynch retail analyst Virginia Genereux wrote in a note to clients dated Friday, pointing out that Wal-Mart had slashed prices on popular toys, electronics and other gift items to lure customers. The retailer’s widely publicized $4 generic drug program should have drawn more shoppers, too.

Investors are watching holiday sales particularly closely this year to gauge how consumers are coping with a slowdown in the housing market that has already hurt home improvement retailers and furniture stores.

Consumer spending accounts for some two-thirds of U.S. economic activity, and the November-December holiday season makes up anywhere from 20 percent to 40 percent of retailers’ annual sales.

Wall Mart n’a pas gazé, OK. Mais, sinon

+ 6% par rapport à l’an passé pour les ventes US. Donc c’est plutôt très bon !

Les effets du krach ne se font pas encore sentir, pas sur la consommation des ménages en tout cas. Cela ne veut pas dire que ce n’est pas pour bientôt.