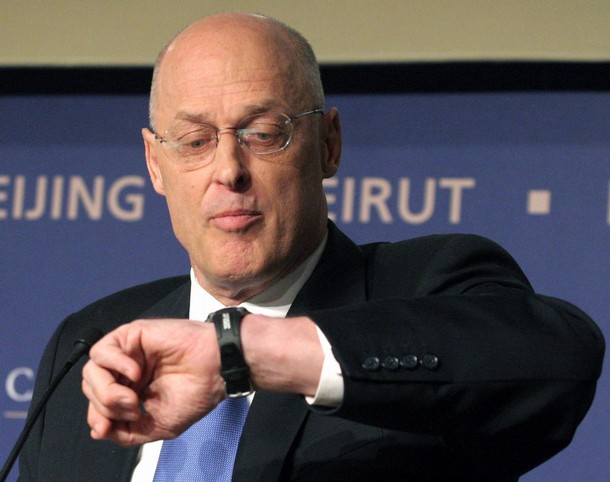

Le secrétaire américain au Trésor Henry Paulson a réabordé ce dimanche le problème immobilier. « Je crois que la principale question (pour l’économie) est celle de savoir quand la plus grande partie de la correction de l’immobilier sera derrière nous car jusqu’à ce que nous le sachions nous allons continuer à connaître une instabilité dans nos marchés des capitaux ». Voilà qui est dit ! Alors que régulièrement je lis des interview de spécialistes qui annoncent que le pire de la crise américaine est passé, Henry Paulson avoue que peut-être le pire n’est pas encore arrivé ce qui a un côté terrifiant lorsque l’on mesure déjà l’ampleur de la crise actuelle sur le système bancaire et l’économie mondiale.

Le secrétaire américain au Trésor Henry Paulson a réabordé ce dimanche le problème immobilier. « Je crois que la principale question (pour l’économie) est celle de savoir quand la plus grande partie de la correction de l’immobilier sera derrière nous car jusqu’à ce que nous le sachions nous allons continuer à connaître une instabilité dans nos marchés des capitaux ». Voilà qui est dit ! Alors que régulièrement je lis des interview de spécialistes qui annoncent que le pire de la crise américaine est passé, Henry Paulson avoue que peut-être le pire n’est pas encore arrivé ce qui a un côté terrifiant lorsque l’on mesure déjà l’ampleur de la crise actuelle sur le système bancaire et l’économie mondiale.

Le « bien au-delà » utilisé par Paulson ne nous renvoie pas en 2009 mais plus tard. Je ne suis pas un économiste pur et c’est un avantage car cela me procure une certaine distance par rapport à telle ou telle déclaration me permettant ainsi de ressentir les choses. Ce que je ressens à la lecture des déclarations de Paulson m’inquiète vraiment.

afp.google.com : « USA: Paulson estime que la crise de l’immobilier persistera bien au-delà de la fin 2008

image sur www.daylife.com

Amazing blog! Do you have any tips for aspiring writers?

I’m planning to start my own site soon but I’m a

little lost on everything. Would you advise starting

with a free platform like WordPress or go for a paid

option? There are so many choices out there that I’m completely overwhelmed ..

Any suggestions? Many thanks!

What’s up, I check your blog like every week.

Your writing style is witty, keep up the good

work!

Wow, this post is fastidious, my younger sister is analyzing these kinds of things, therefore I am going to convey

her.

Hi there i am kavin, its my first time to commenting anywhere, when i read this

article i thought i could also create comment due to this good piece of

writing.

Write more, thats all I have to say. Literally, it seems as though

you relied on the video to make your point. You obviously

know what youre talking about, why throw away your intelligence on just posting videos to your site when you could

be giving us something enlightening to read?

Financial advisors business is individuals business.

Now it is time to decide your specific investments.

And this is an funding risk worth taking.

Thank you for sharing your info. I really appreciate your efforts and I will be waiting for

your further write ups thank you once again.

Buyers do pay direct and oblique costs.

I am in fact grateful to the holder of this website who has shared this impressive piece of writing at here.

Nice response in return of this question with real arguments and

describing the whole thing regarding that.

Now it’s time to decide your specific investments.

And that is an funding risk worth taking.

Schwab Clever Portfolios invests in Schwab ETFs.

A monetary advisor is your planning companion.

Monetary advisors business is people enterprise.

That is true for funding recommendation as properly.

That is true for investment advice as nicely.

Contemplate investments that supply rapid annuities.

A monetary advisor is your planning companion.